June 3, 2021 Meeting Notes

/June 3, 2021 Lunch & Learn

Our speakers are Jaydra & Melissa!! The topic is Creating a QBO file from a tax return

Why do clients ask for this?

Their books were destroyed, they were wildly inaccurate, they never had books they owned (For instance a CPA did their magic somewhere)

Where do tax returns come from?

Financial Statements, Company books & records, spreadsheets, bank statements, misc notes, MATH!

Tax returns are essentially a rearrangement of financial statements shaped in a way that the government likes

P&L

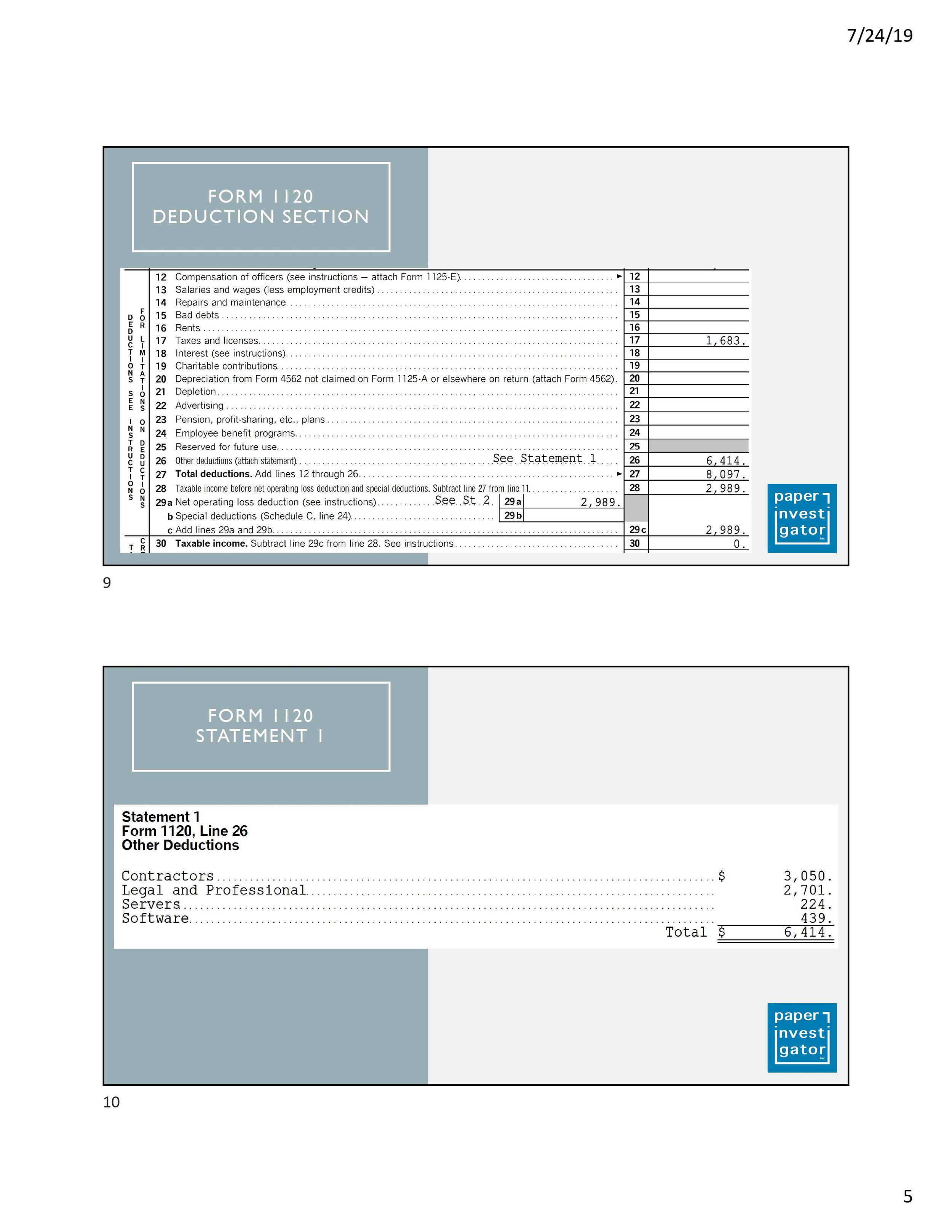

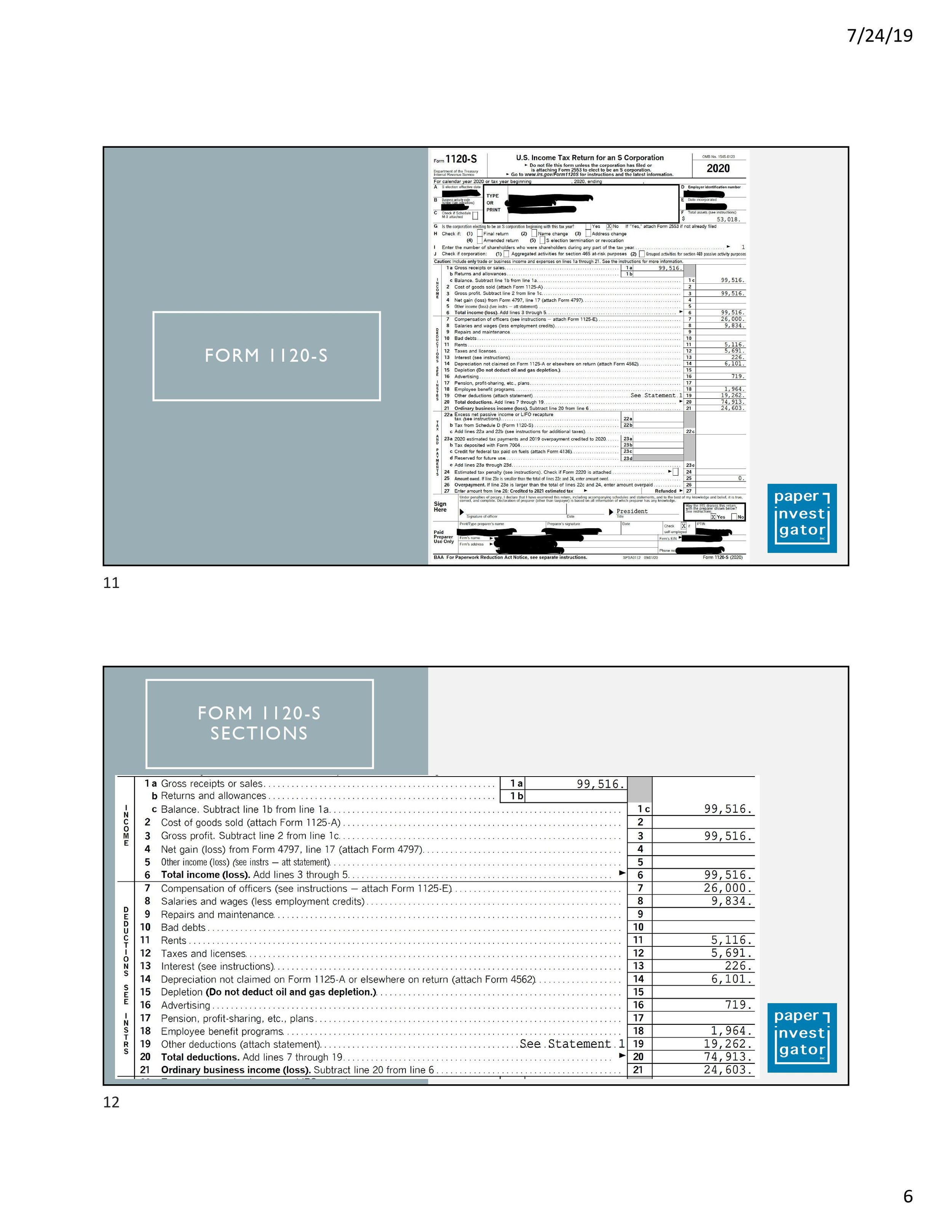

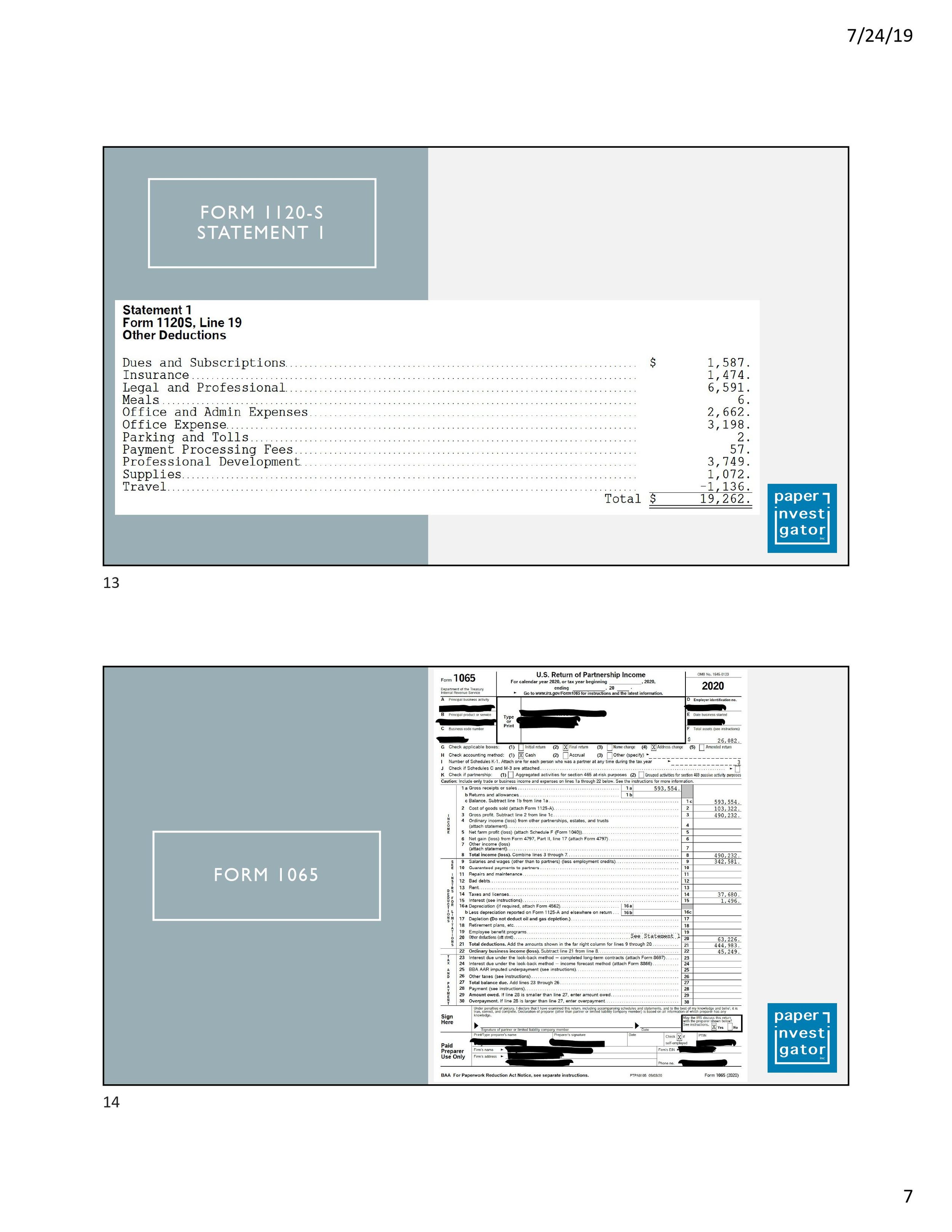

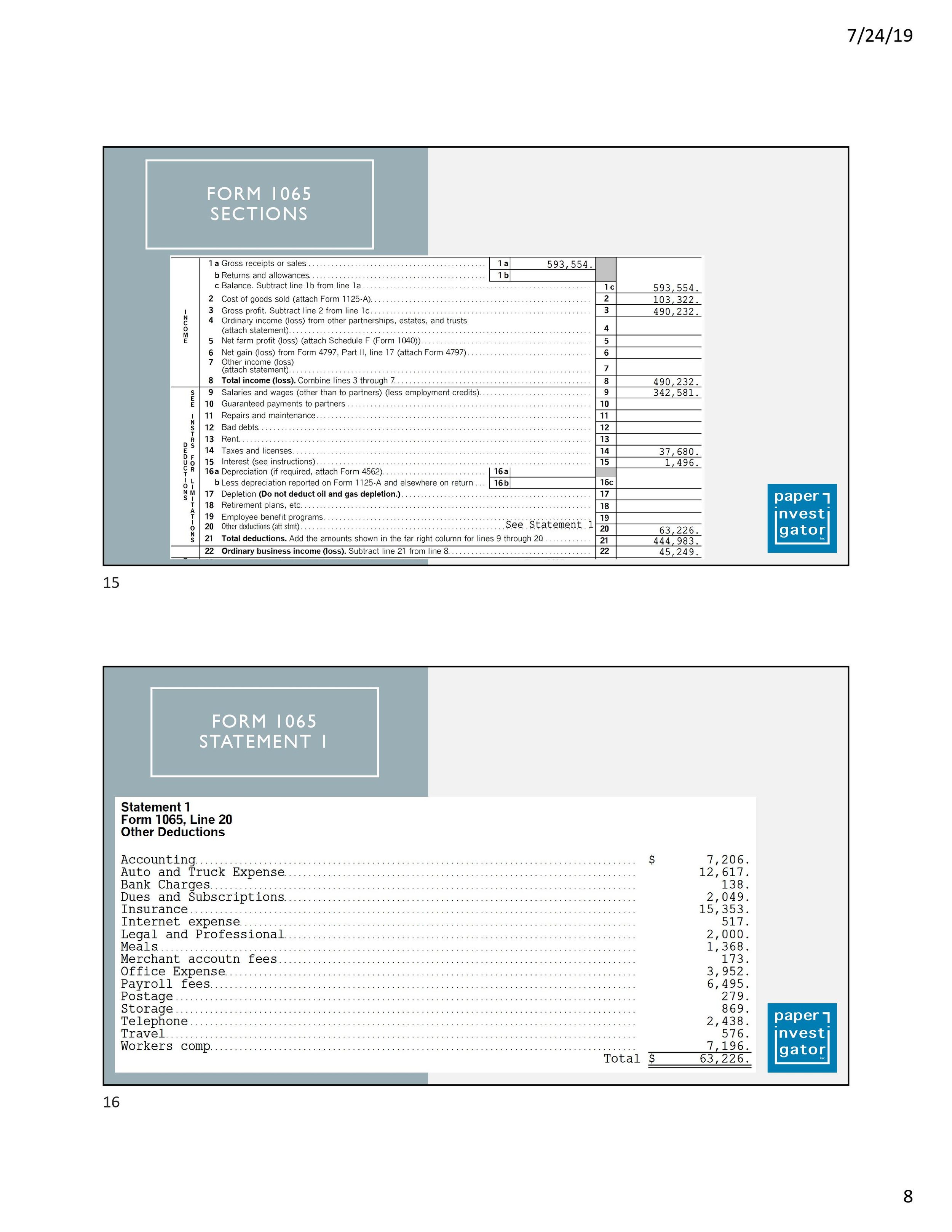

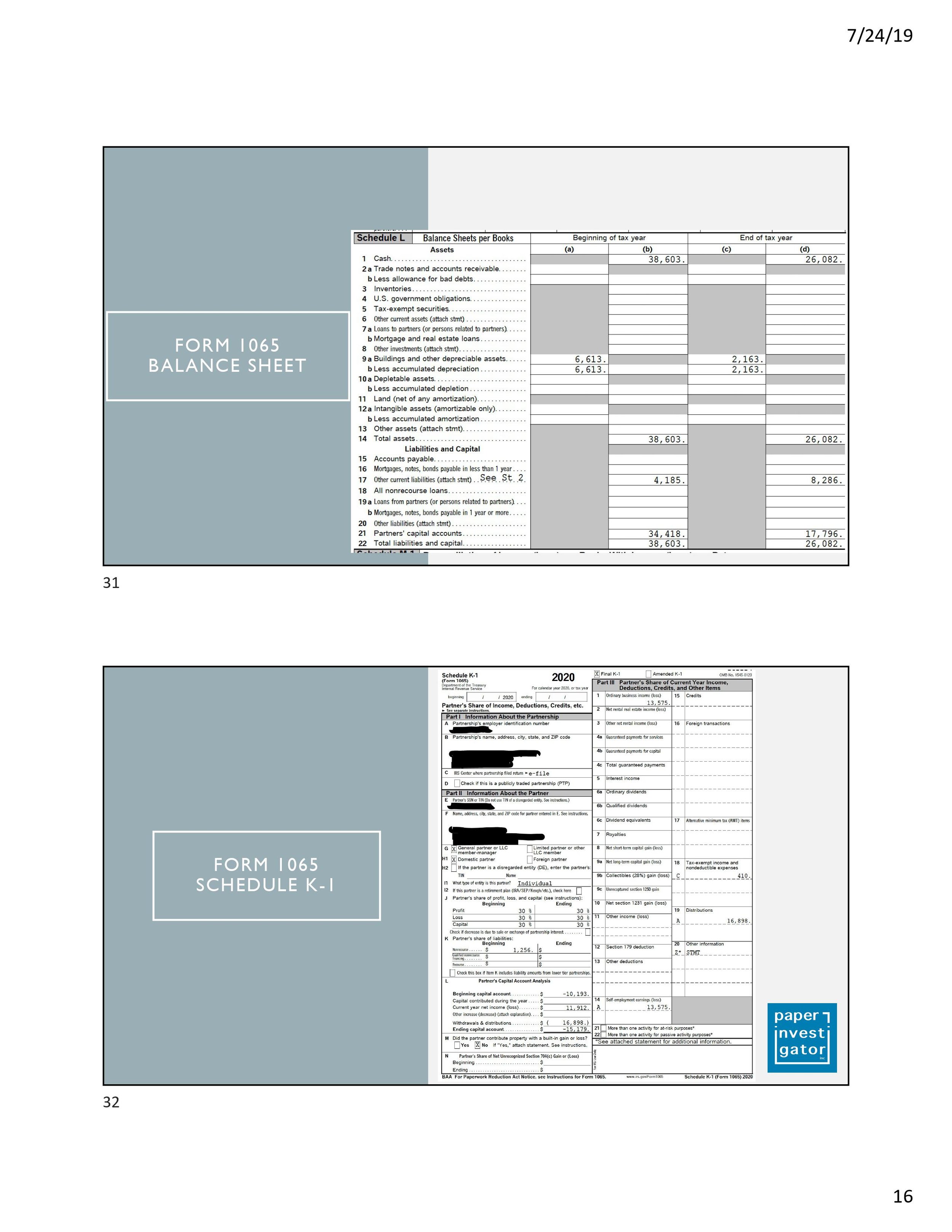

Corporate entities - 1120, 1120-S, 1065

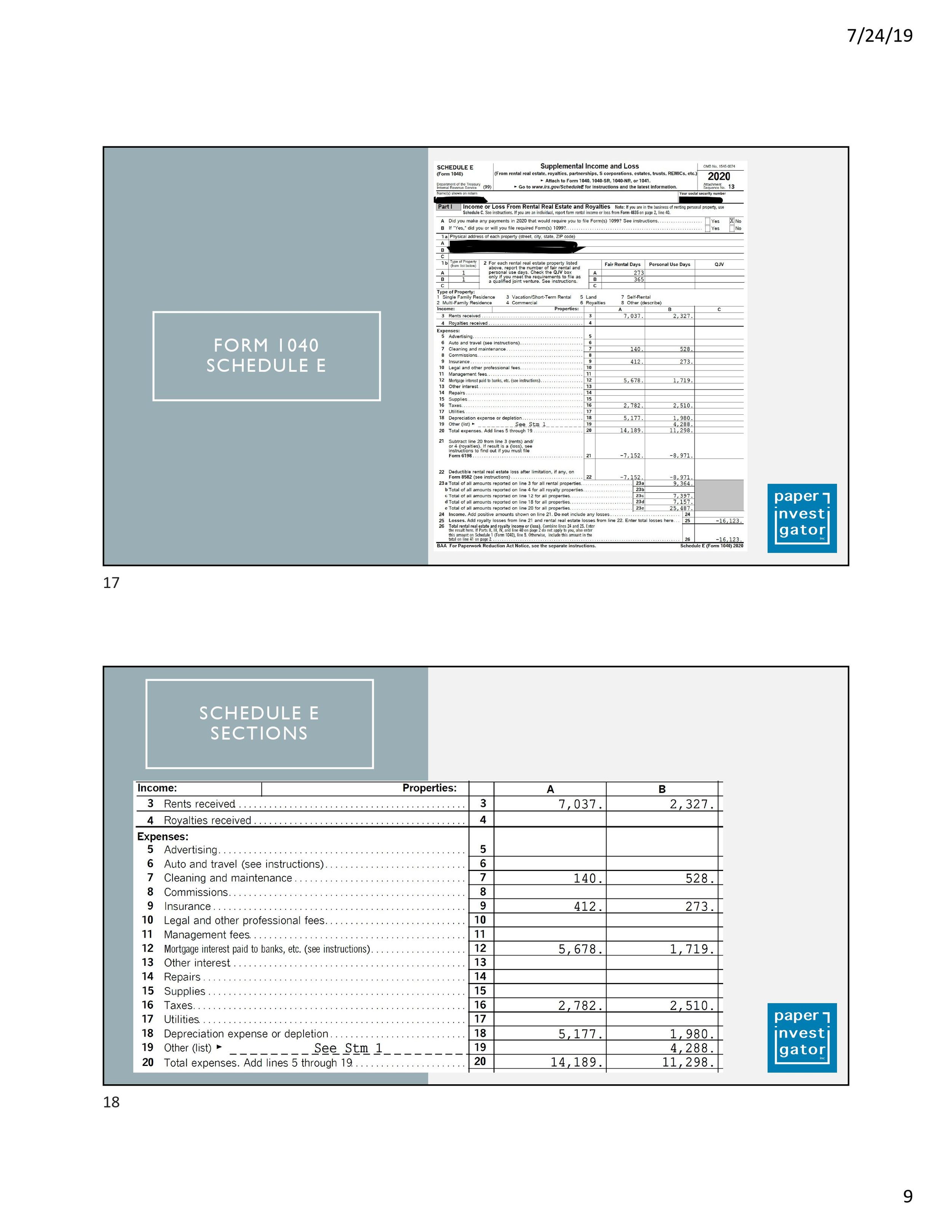

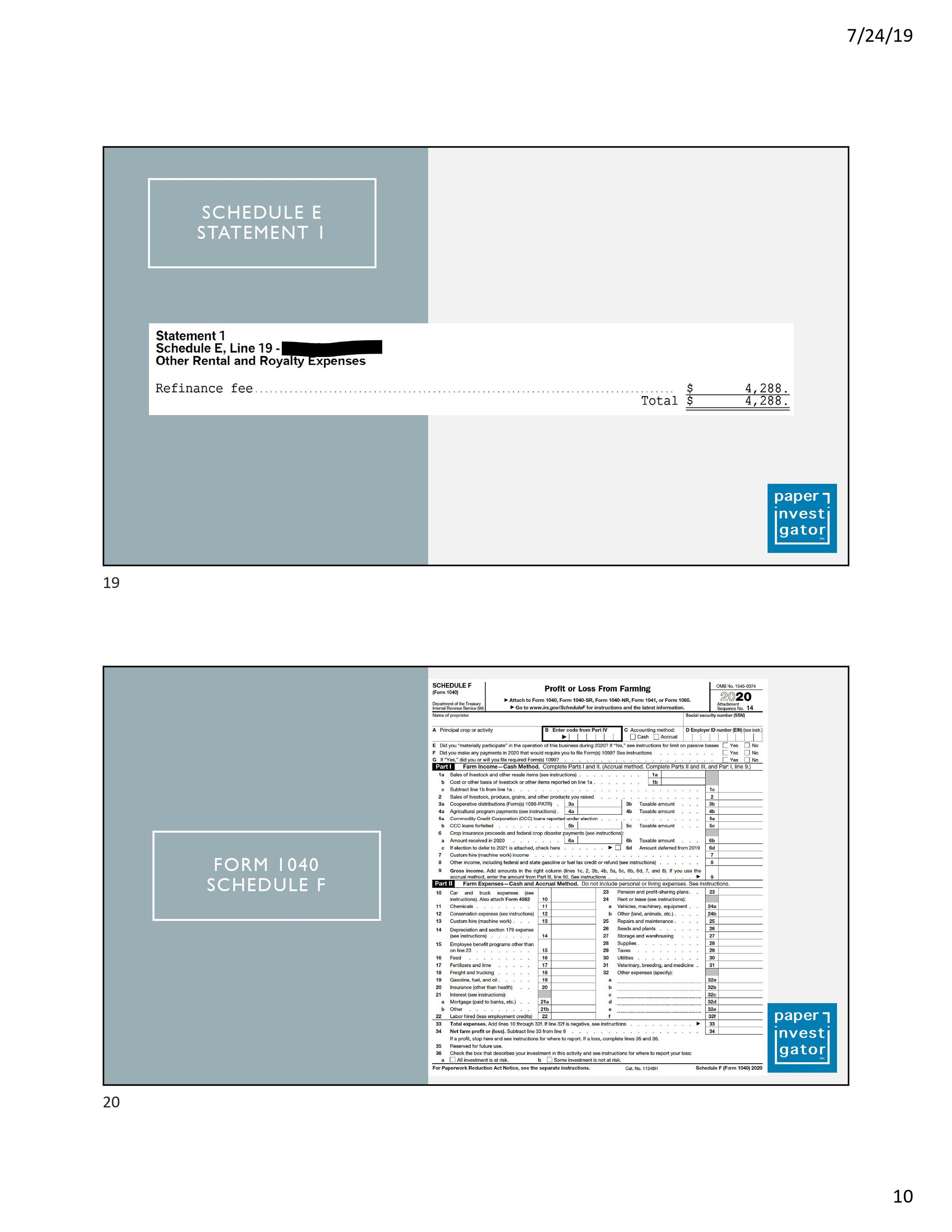

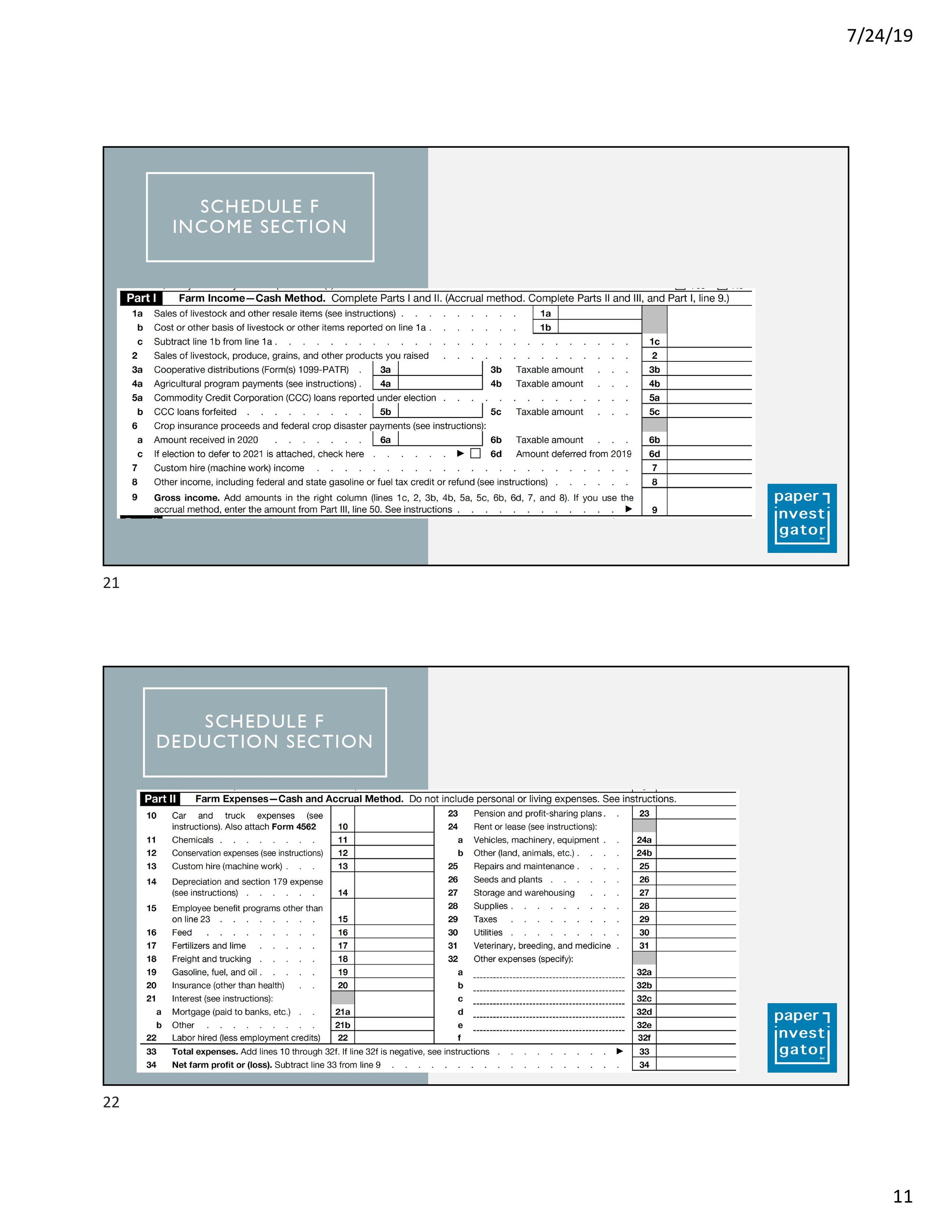

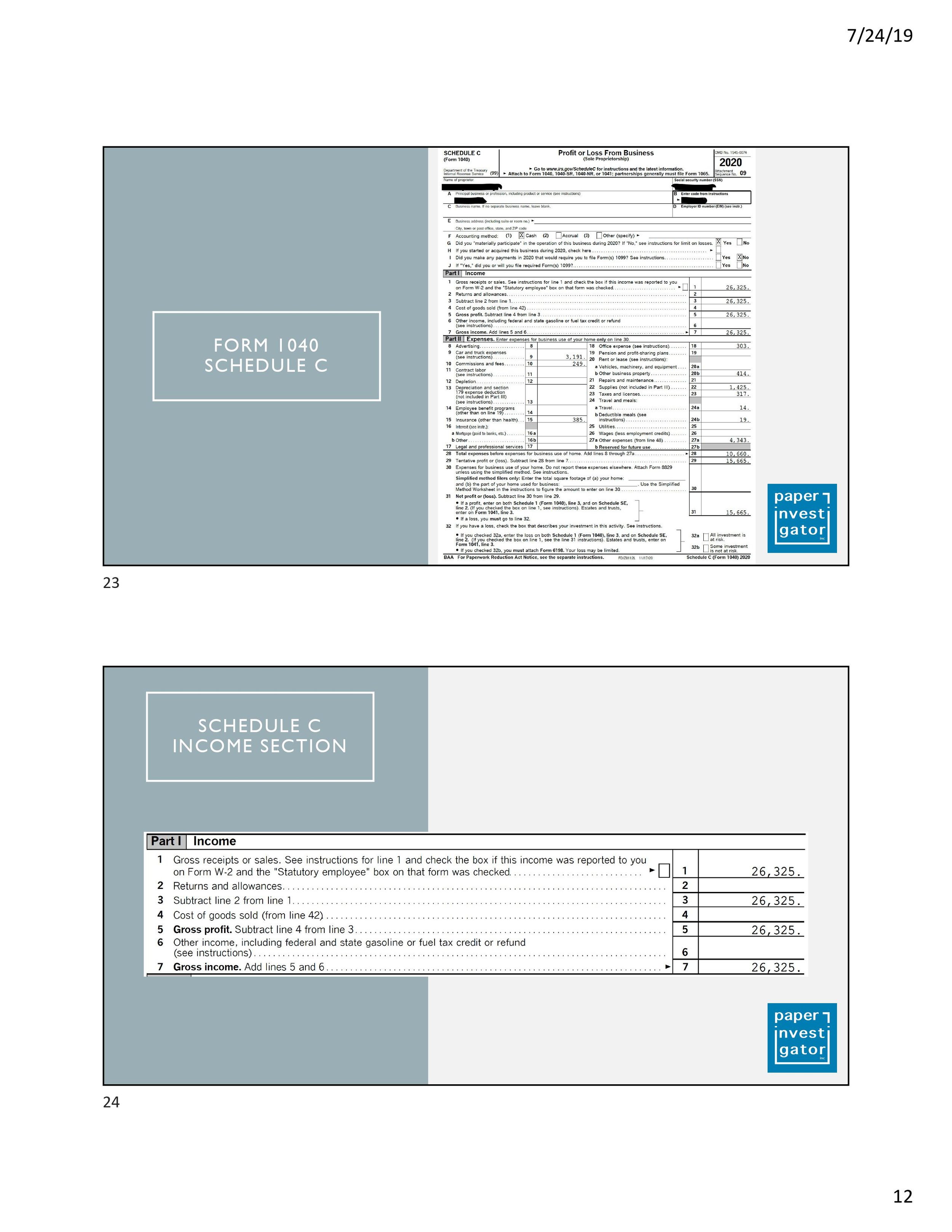

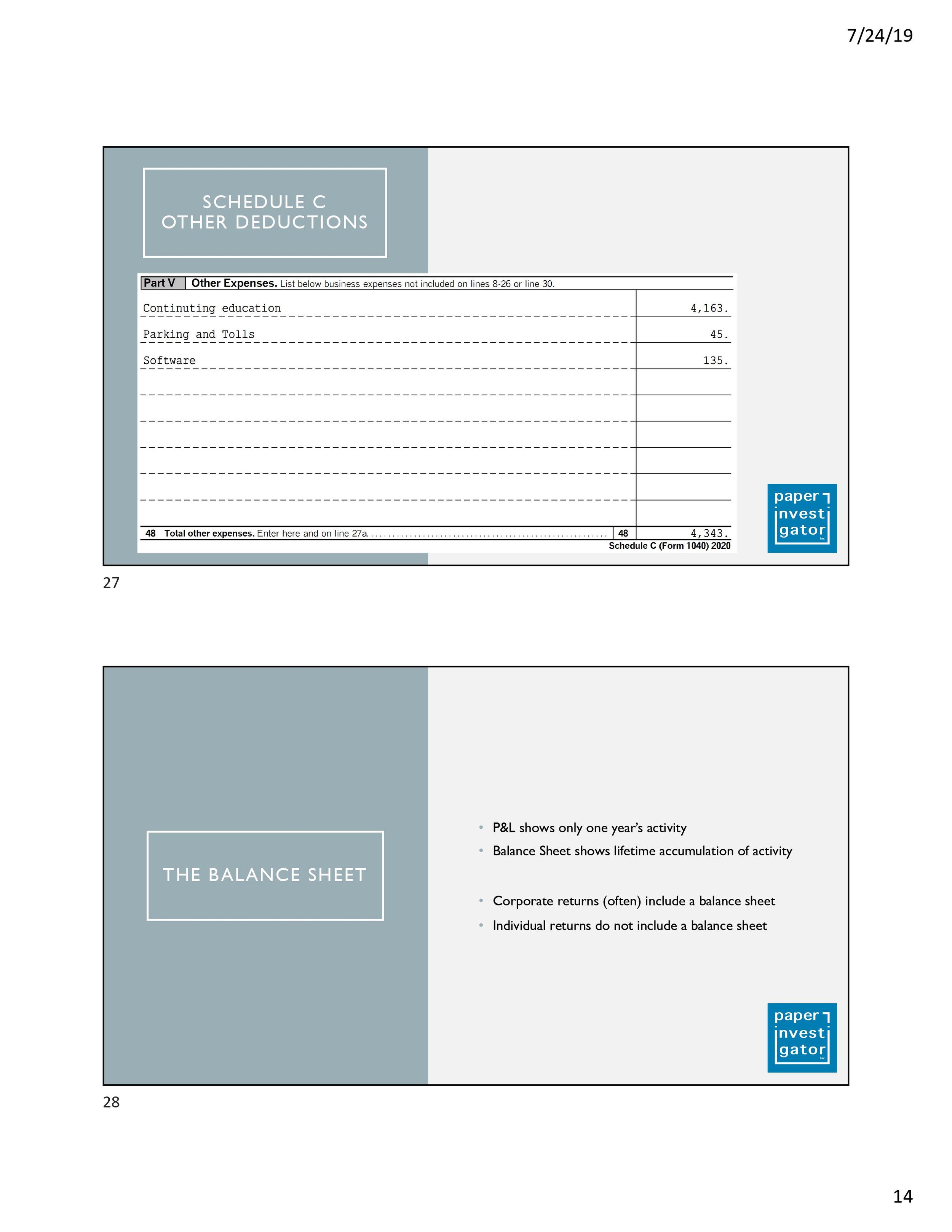

Non Corp entities - 1040 schedule e, schedule f, schedule c

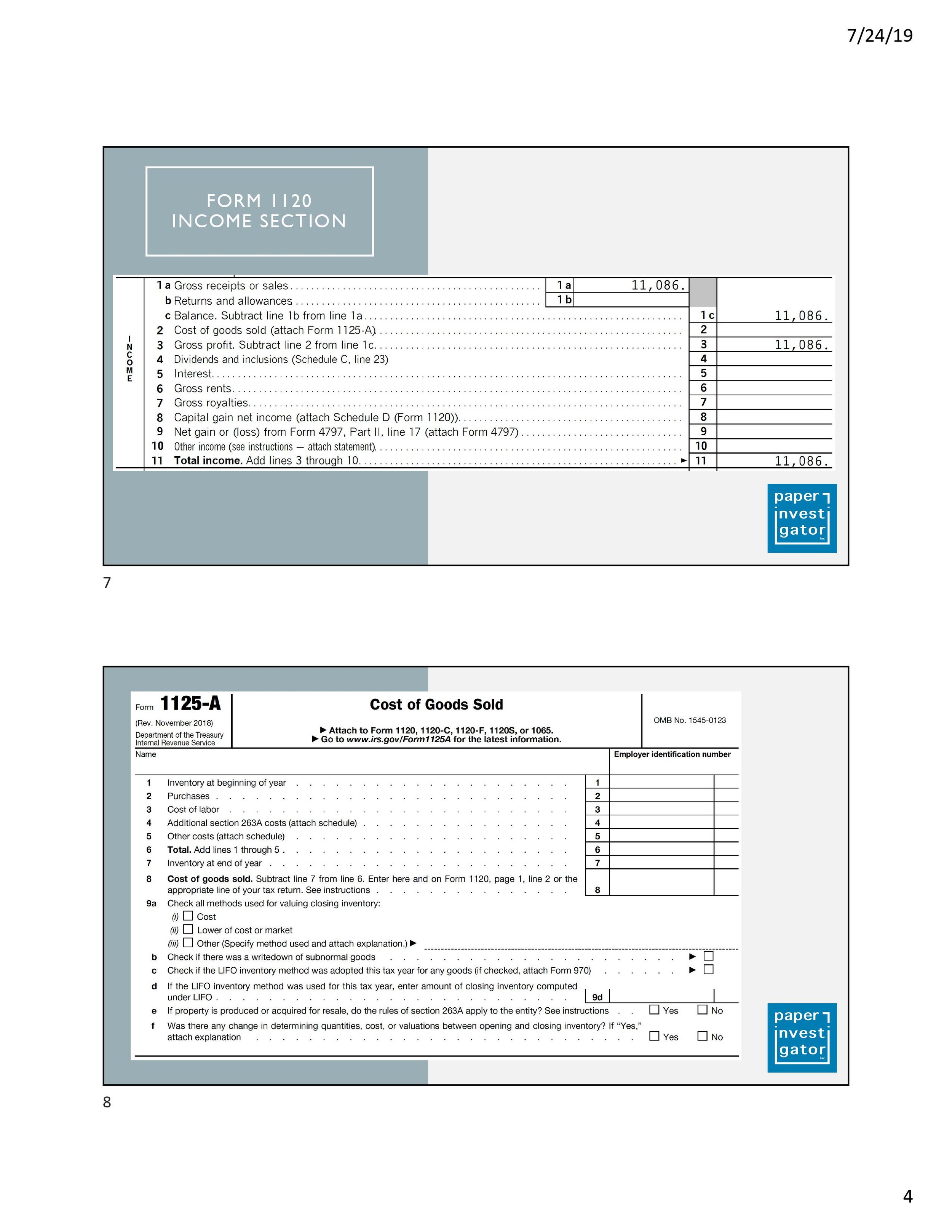

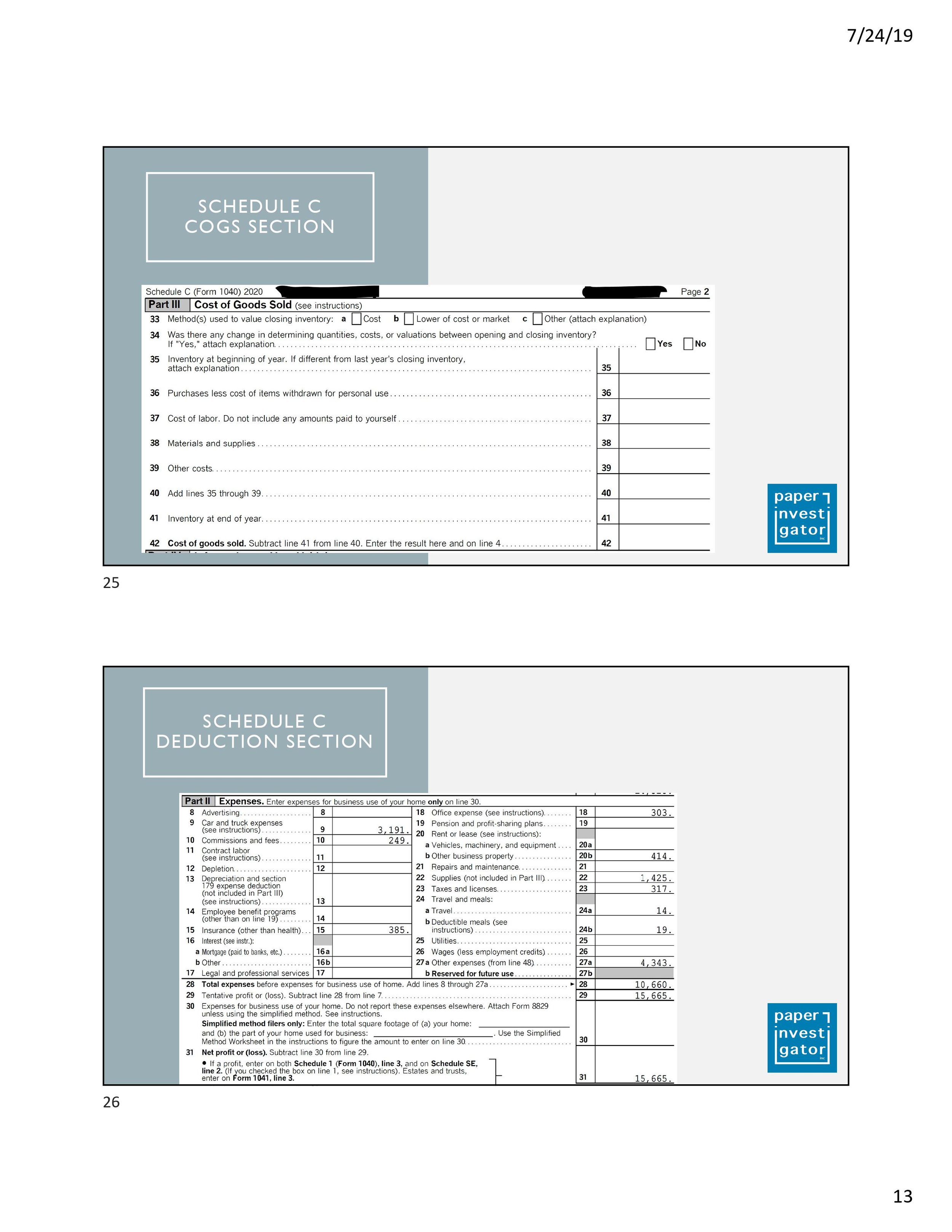

What the IRS classifies as cost of goods sold is mainly relating to manufacturing/retail related - any costs related to items you produce for clients

It is preferable in the chart of accounts to have separated out 100% meals, 50% meals, 0% meals etc

The IRS likes it when things match, thats their favorite!!

Example: Do the officer wages match on the P&L & theW3???

If there is a difference usually its payroll taxes, health insurance or retirement

Also you have to remember you are coming from a mess - you just want a clean start - and some of this information wont really matter going forward

A P&L funneling into a tax return will look different - the same for coming out of a tax return. Clients may say this looks different that they remember

Some lines on the tax return weren't actual dollars spent, and the book amount and the tax line amount will be different

Retained Earnings will be the plug account when entering the JE amounts of all the income/expenses from the tax return

If entering in JE for payable/receivables, must include vendor names and invoice numbers!

Don’t recommend entering an amount for payable/receivables without backup documentation or if the client is sure that that money is owed and who owes it

MOST tax returns are filed on a cash basis

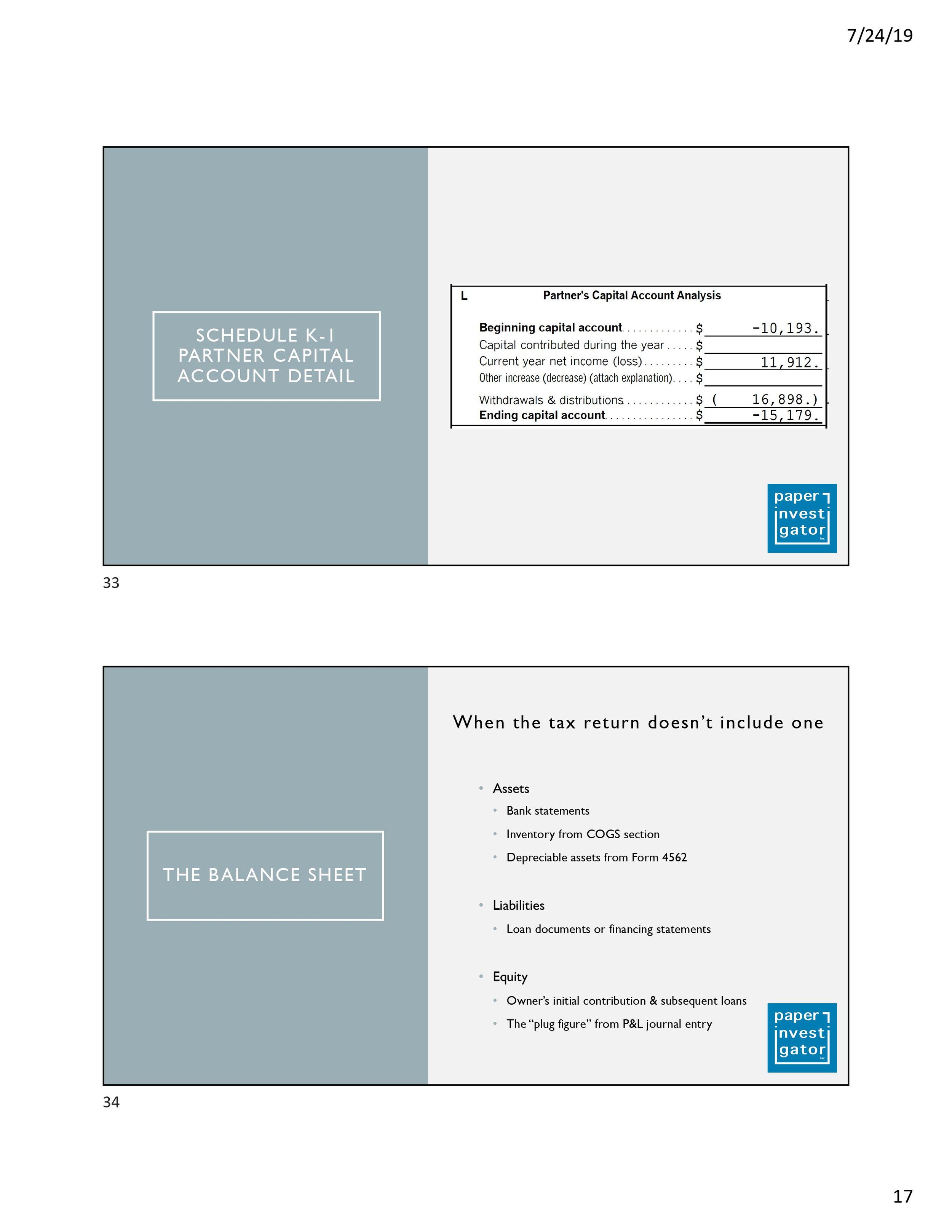

Important For Partners Capital/Schedule K - cant just be one line, need to separate who gets what amounts!

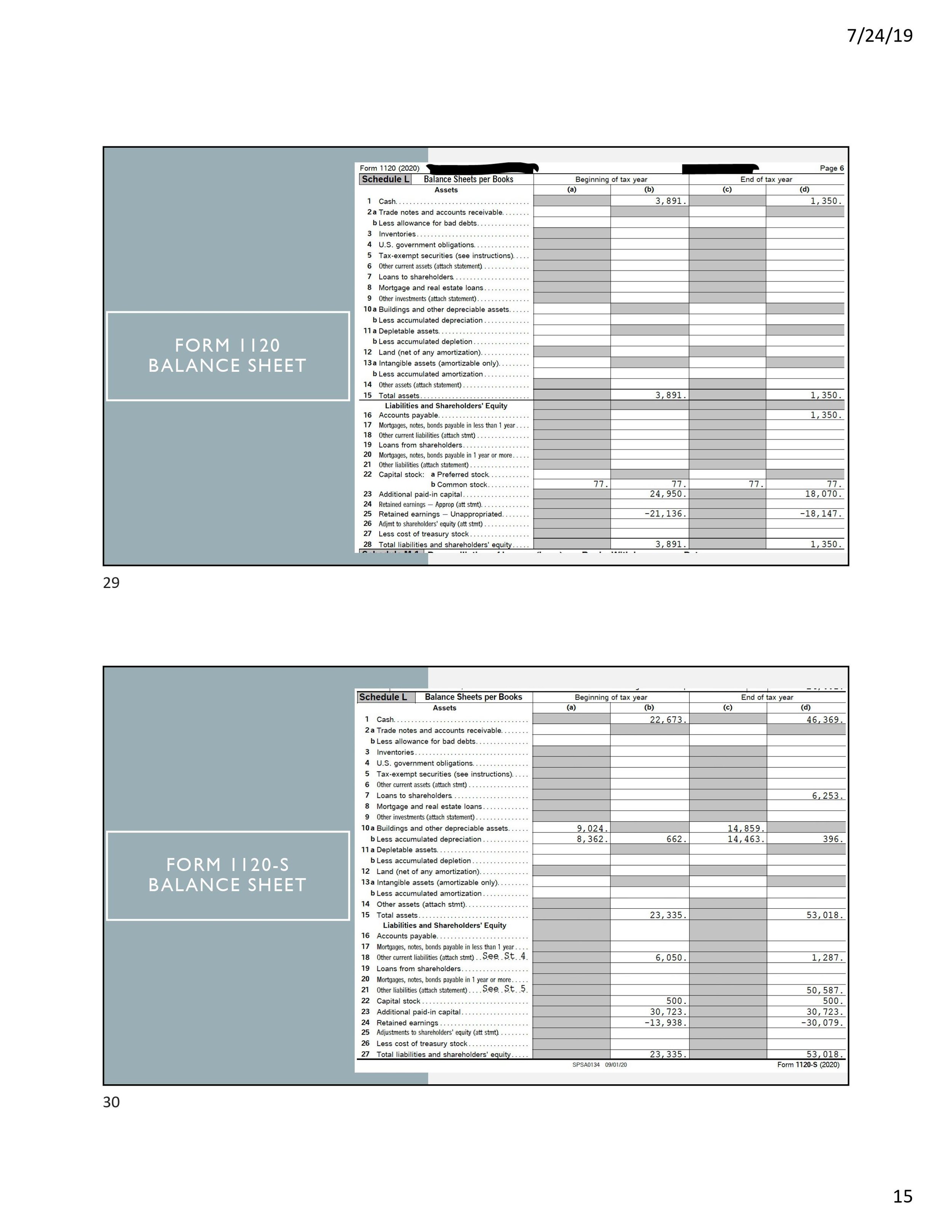

When the tax return does not include a balance sheet -

For assets look at bank statements, inventory from COGS, Depreciable Assets

For liabilities look at loan documents or financing statements

For equity look at owner initial contribution and subsequent loans and then plug the figure from P&L JE

Remember it ok to ask CPA or EA what should be on the balance sheet if you feel like it is above

Remember it doesn’t have to be perfect

Its largely unattainable

What are the important points?

What can you let go?

How do you figure out what the exact goal is with your client?

You can start with a trial balance and build out

Find what you can verify and let the rest go?

Its more important that it makes sense than necessarily matches what was once there

If you don’t see a truck in their possession, don’t put them in assets

If you don’t see a stack of bills, don’t put them in