July 2019 Meeting Notes: Non-Profit Accounting

/Presenters: Phyllis Shelton & Jackie Van Anda of The Bookkeeping Collaborative

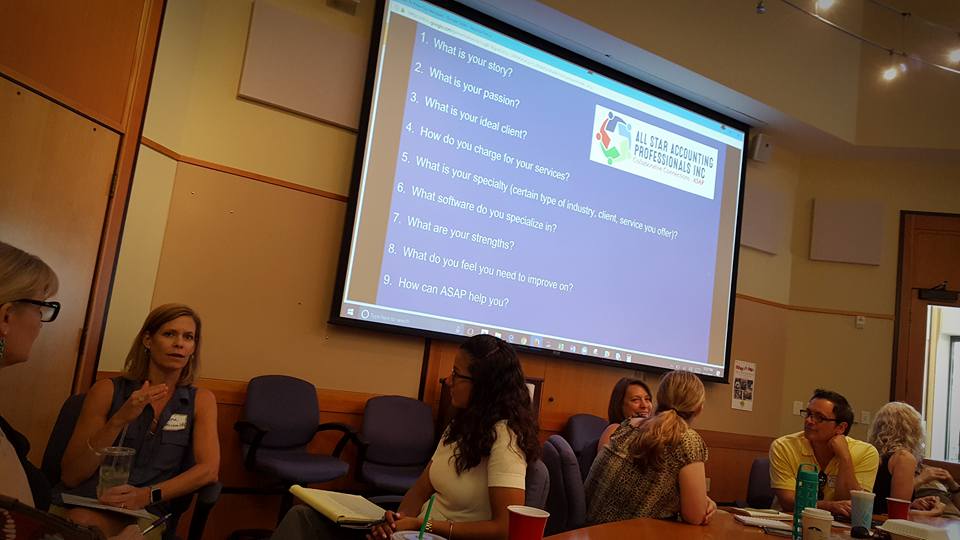

· President Kim Boaz opened the July meeting and provided the upcoming events and meeting.

· Upcoming meetings/events:

o Wednesday, July 17 is the next Virtual Zoom Happy Hour from 4:30 -5:30. This is a casual time so please feel free to jump in and/or leave as available.

o On July 15, the Portland Woodard Group is hosting a Lunch & Learn at 11 AM at the McMenamin’s Chapel Pub. The topic is Scaling New Heights.

o Next All-Star Accounting meeting on August 1- topic is Value Added Pricing.

o Next quarterly social – September 17 from 5 – 7 PM at the Beaverton food carts near city hall. It is a covered area with 30 food carts. Spouses and partners welcome.

· Kim Boaz asked each person present to introduce themselves and mention if they work with non-profit organizations. Speaker coordinator Summit Hiett introduced the presenters, Phyllis Shelton and Jackie Van Anda of The Bookkeeping Collaborative. Phyllis and Jackie have worked with over 160 non-profits and currently have 70 active clients. Their non-profit experience ranges widely from education, youth, arts benevolent and religious.

· Phyllis feels QuickBooks desktop is best for non-profits rather than the Online version and emphasized that use of classes is important in the chart of accounts. They use TeamViewer and LogMeIn in working with their clients. Phyllis keeps the Master copy of QuickBooks for her clients.

· Jackie provided two hand-outs. The first listed differences between Nonprofits and For-Profit entities and included important websites. The second hand-out provided helpful information on managing restricted funds.

· The Bookkeeping Collaborative uses the job cost function for restricted funds and uses customers in QuickBooks for revenue sources. Classes are used for restricted and unrestricted items. Expenses are further segregated between program, management/general and fundraising.

· As a rule of thumb, 85% of expenses used for program and 15% for fundraising and management expenses is a good allocation for a nonprofit.

· Payroll taxes – nonprofits are exempt from TriMet payroll taxes, but no one is exempt from the State transit tax.

· Chart of Account guidance – it is helpful to coordinate the funding sources and the chart of accounts to avoid adding unnecessary new general ledger accounts.

· Budgeting is very important for nonprofits and a service offered by The Bookkeeping Collaborative.

· Fees – The Bookkeeping Collaborative bills a flat monthly fee. They estimate the annual fees based upon service needs and divide the amount by 12. They feel they are a very reasonable CFO for their clients.